Financial Wellness Program

Financial Wellness Program

CashCourse Scholarship Opportunity

Who doesn’t love free money? Now is your chance! If you complete both CashCourse topics by the deadline, you will be entered into the drawing for an MLC Direction scholarship on your student account. There will also be monthly drawings for other prizes!

DEADLINE to complete all requirements: 3/23/25 by 11:59pm

- Freshman: 4 @ $50 * Sophomore: 4 @ $50 * Junior: 4 @ $75 * Senior: 4 @ $100

REMINDER: After 3/25/25, students with incomplete topics will be placed on a registration hold.

This will prevent you from registering for 2025-2026 classes.

Online Activities

Consultations

Group Sessions

Resources

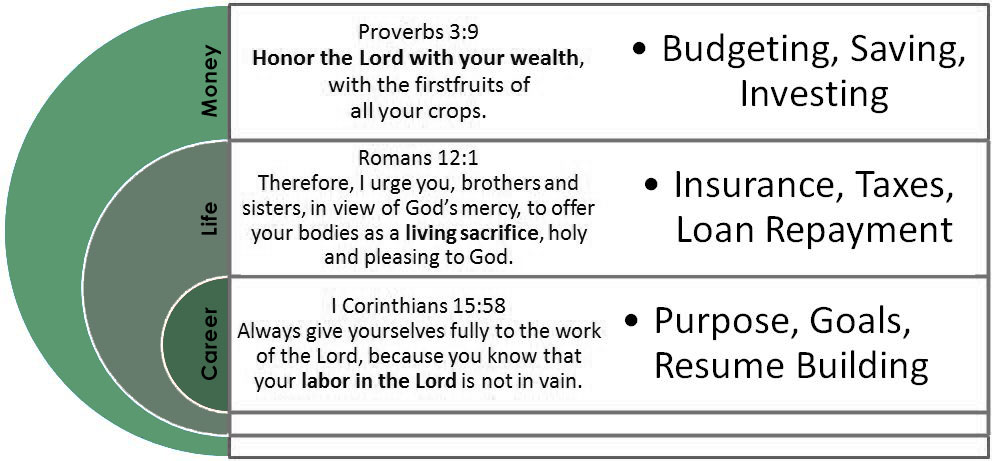

30 Step Path to Financial Wellness

- 30 Step Path to Financial Wellness ebook

-

- Examine your attitudes about money in order to change your financial situation.

- Review basic financial tips for college students.

Budget

- Basic Principles:

- Save for an Emergency Fund

- Learn to live on LESS

- Limit your “non-essential” purchases

- Using an app to track your spending can help you manage your money:

- Using a budgeting app can help you track both income and spending:

- Everydollar web-based & app

Career Data and Exploration

- O*NET is the nation’s primary source of occupational information, providing excellent resources.

- Bureau of Labor Statistics: estimate your future salary

- Help creating a RESUME

CashCourse

- CashCourse: finish your assignments and review financial related resources

- Ask a Financial Expert: http://www.cashcourse.org/financial-tools/financial-experts.aspx

Credit

- How to Build Credit (and why it is important):

https://www.consumeraffairs.com/finance/how-to-build-credit.html

- Check your credit report at least once per year from one of the 3 credit bureaus:

Experian – TransUnion – Equifax — annualcreditreport.com - Place a credit freeze to help prevent fraud:

https://www.creditkarma.com/id-theft/i/how-to-freeze-credit/ - Credit cards can help you build your credit if used properly

- Pay your full balance every month AND on-time

- If you don’t have the money for something, DON’T buy it!

- Avoid canceling unused accounts – this generally increases your credit utilization (how much of the available credit you are using) and reduces your credit score

- Check out the NerdWallet review of best student credit cards or the US News comparison.

- Steps to Improve Your Credit Score:

http://www.experian.com/credit-education/improve-credit-score.html - Additional Resources from SouthPoint Financial Credit Union

- Identity Theft:

Checking your credit report will help you know if someone is using your personal information to open fraudulent accounts. If this happens to you, learn how to recover from identity theft.

Cutting Costs

- Strategies for cutting costs, saving money, and making smart financial decisions:

Blogging for Change

Date on a Dime: Inexpensive and Fun Activities

Dave Ramsey Car Guide

- Information on car insurance, car maintenance, car loans, resources and more:

Car Guide

Healthy Eating on a Budget

- Making your own food versus going out to eat can save you money (and calories!)

- Tips for healthy eating on a budget

- 20 Recipes for eating healthy on a budget

Resources

Investing Basics

Legal Documents

- Create your own Power of Attorney Form

- Create your own Health Care Directive Form

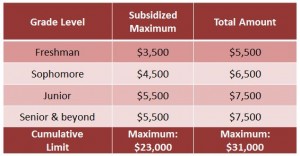

Loans

Don’t borrow more than your first year’s Gross Earnings!

- Set up an account with your loan servicer.

- Estimate your loan repayment with the Federal Student Aid Loan Estimator

(select Proceed and enter your loan totals or loan estimates)

Private Loan Consolidation:

- Will consolidating save you money? Check out additional information about private loan consolidation.

Direct Loan Consolidation:

- Do you have both Perkins AND Federal Direct (Stafford) loans? Discover more information about a Direct Consolidation Loan.

Student Loan Consolidation Guide:

- Learn the basics of student loan consolidation.

Master Your Money

- Additional resources on the following topics

- Spending

- Budgeting & Saving

- Credit

- Debt & Loans

Minister of the Gospel - Quarterly Tax Estimates

- You are considered self-employed (for social security purposes) and an employee for other tax/fringe benefit purposes.

SECA (Self-Employment Contributions Act) covers both social security and Medicare taxes at 15.3%

SECA must be paid on all income (including the amount of housing allowance and/or fair market value of provided housing)

- Income tax/social security tax/etc. will not be automatically withdrawn from your paycheck.

- Plan on setting up a separate account to deposit 20-25% of each paycheck (work with a tax preparer to know how much to set aside). You can then pay your quarterly tax estimates directly from this separate account to prepare for the large payments.

Quarterly tax estimates are due on:

April 15 (Jan 1 to March 31)

June 15 (April 1 to May 31)

September 15 (June 1 to August 31)

January 15 (Sept 1 to Dec 31) *paid the following year

- Guidance from the IRS regarding Estimated Taxes

- When you complete your taxes, talk to your accountant/tax preparer! Let them know you are a Minister of the Gospel so they can help you properly complete your tax return information.

- For more information on tax implications, review information provided by GuideStone.

Paycheck & Taxes

- Gross pay – deductions and taxes = Net Pay – fixed expenses = Disposable income – elastic expenditures = Discretionary income

- How to Read a Pay Stub video

- Take-Home Paycheck Calculator

- Overlooked Tax Breaks for Recent College Graduates article and IRS Pub. 970 Education tax benefits

- Education Tax benefits (including student loan interest deduction)

- File taxes online: Turbo Tax, Tax Slayer, Credit Karma, H&R Block

- Volunteer Income Tax Assistance (VITA) free tax help for qualified individuals

Paying for College

To help keep college costs down,

good planning is the best strategy!

- Take AP Courses that will transfer for your major (or as needed elective credits.)

- Save money from high school graduation and work as much as possible in the summer.

- Utilize the available payment plans .

- Apply for scholarships.

- Apply for financial aid every year.

- Minimize student loans – only borrow what you need.

- Try to graduate in 4 years.

Pre-Seminary Students

- Review the current Wisconsin Lutheran Seminary catalog.

- During your Financial Review Meeting, preparation for seminary payments are reviewed.

Student’s Guide to Fraud Scams

- The Student’s Guide outlines different scenarios for a variety of scams that range from tax scams and identity theft to PayPal and rides share scams. Each section provides prevention tips for each situation and a top 10 list of fraud prevention tips are share.

What are students saying about the Financial Review Meetings?

Disclaimer

MLC believes that developing financial literacy and understanding financial wellness are critical aspects of your education.

Staff who work with students on financial issues do not provide investment, legal, or tax advice. This website and information provided is for general educational purposes only. If you need investment, legal, and/or tax advice, please consult with one of these professionals.

The links to third-party financial resources are provided as a convenience for informational purposes only. MLC neither endorses nor approves any of the products, services or opinions of the entities or individuals associated with these links. MLC and MLC Direction bear no responsibility for the accuracy, legality or content of any external site associated with the links provided or any subsequent links.

Department Directory

Email: mlcaid@mlc-wels.edu

Phone: 507-233-9154

Department Directory

MLC Direction Instagram

Follow us on Instagram for Financial Aid information such as dates/deadlines and scholarships!

MLC Direction Facebook

Follow us on Facebook to stay on top of important Financial Literacy topics!