Thank you for your interest in Martin Luther College (MLC) and MLC Early Childhood Learning Center (ECLC). MLC and MLC ECLC offer a rewarding work environment with a Christian missionary focus that enriches our college’s mission of preparing teachers, pastors, and staff ministers in the Wisconsin Evangelical Lutheran Synod (WELS).

Below you will find a current listing of employment opportunities at Martin Luther College and MLC Early Childhood Learning Center.

Interested individuals should apply online for positions listed below, and may contact the Human Resources Office at (507) 354-8221 for additional information.

Students who are looking for an on-campus and/or off-campus job should visit our Student Employment page. Local businesses or individuals wishing to post an off-campus job opportunity can submit job information on the Student Employment page for approval, or contact the Financial Aid Department.

Current open positions

- MLC does not have any unfilled positions at this time, but we encourage you to check back regularly for opportunities.

COMPENSATION PHILOSOPHY

Colossians 3:23-24: Whatever you do, work at it with all your heart, as working for the Lord,

not for human masters, since you know that you will receive an inheritance from

the Lord as a reward. It is the Lord Christ you are serving.

Introduction

At Martin Luther College, our compensation philosophy is built on service to the MLC mission of preparing pastors, teachers, and staff ministers for work in the WELS, to proclaim the truth of the Holy Scriptures in churches, schools, and other institutions. This compensation philosophy recognizes that our college’s mission makes it critical to be wise stewards of the financial resources we receive from our students, donors, and synod. At the same time, we know it is important to attract and retain a strong workforce by providing a strong compensation package with generous benefits, so that our workers may lead God-pleasing lives and be a blessing to others.

Compensation

- We respect governmental laws that require transparency 1 in publishing pay ranges for open lay worker positions and recognize that working in ministry includes many non-monetary rewards. Because our philosophy encompasses more than base pay, we encourage our applicants to learn more from the hiring manager, and we encourage our supervisors and lay workers to engage in meaningful discussions with the goal of acknowledging the rewards of working for a religious non-profit. (See #8).

- We encourage our candidates to share their compensation expectations, rather than their compensation history.

- We conduct a compensation analysis every other biennium, or more often as the market demands, employing data collected through market research, salary surveys, and higher education reporting. Sources include the Bureau of Labor Statistics, CUPA-HR, The Chronicle of Higher Education, The Management Association (MRA), Society for Human Resource Management (SHRM), and job aggregators such as Indeed, Glassdoor, ZipRecruiter, and Salary.com. The research results are reported to the MLC Administrative Council to determine pay grade assignment per lay worker position description.

1 Minnesota Statute 181.173 requires employers with at least 30 employees to include pay rate and benefits information in job postings and solicitations.

Compensation Levels

- Individual compensation levels within the assigned lay worker pay grade are based on factors including, but not limited to, job responsibilities, performance evaluations (see #12), individual experience, education credentials, physical requirements, exposure to safety-related working environments, equipment usage, working hours, complexity or impact, demands, expectations and workload, budgetary availability, tenure, field experience, applicant talent pool, and local cost of living. 2

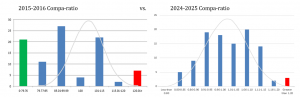

- We perform annual reviews, and mid-year reviews as market conditions change, of individual compensation within the assigned pay grade, using the compa-ratio method. We report review results to the MLC Administrative Council to ensure accountability, fairness, and consistency in our processes, provide improvement opportunities, and ensure that our compa-ratios align with the college’s compensation structure and the college’s budget.

2 As of 11/25/2024, New Ulm, Minnesota, according to bestplaces.net, has a Cost of Living rate of -23.5% lower. Therefore, MLC called workers are not eligible for a COLA.

Lay Worker Compensation Philosophy

- To understand the lay worker compensation philosophy, it is important to consider the following:

- Compensation for called workers is based on the fiscal year salary matrix in accordance with the WELS Called Worker Compensation Guidelines. While the salary matrix appears to be below market, in addition to the base salary, called workers receive a cash housing allowance based on a three-bedroom rental in Brown County. The total called worker compensation is the base salary from the salary matrix, plus the cash housing allowance. Called workers have all the rights and privileges of called workers as extended to them in their calls to the college. Called workers with WELS Ministry Certification are Ministers of the Gospel and are eligible to receive SECA (Self-Employed Contributions Act) compensation, COLA 2 (Cost of Living Adjustment), and Housing/Parsonage Allowance (or Housing Equity, if applicable). A Minister of the Gospel is considered self-employed for Social Security and Medicare tax purposes, and an employee for other tax and fringe benefit purposes. These called worker guidelines are what our graduates can also expect when they receive a call.

- Wages for student employees and summer employees are in keeping with federal minimum wage requirements. Student jobs and summer jobs are compensated based on four tiers, which can be found in the Tiered Compensation Chart. These tiers are based on responsibility, special skills, supervisory responsibility, training, competency, environment, working conditions, and equipment usage.

- Our adherence to these established guidelines and our religious non-profit status mean that MLC and the WELS lag the market in both our called and lay worker compensation structures. There are surely other organizations where people can be paid more than they can at MLC, but we want to be honest with our workers and candidates. While our below-market or lagging-market philosophy is not expected to change, there are certain non-monetary benefits to working with MLC and the WELS: our mission, service to our Lord, our culture, our people, the college students, the childcare children and their families, and the insurance and benefits.

Insurance and Benefit Packages

- With our philosophy encompassing more than base pay, it is important to note the generous insurance and benefit packages.

-

- MLC full-time lay and called workers have access to a nearly $37,000 3 insurance and benefits package for which the worker pays very little. This includes no-premium health insurance for any tiered coverage—including family coverage, no-premium vision coverage for whoever is on the health insurance plan, no-premium short-term disability with two-thirds compensation after the 21st day, long-term disability at a reasonable rate, no-premium corporate life insurance with a coverage level at two times the annual salary, voluntary life insurance at reasonable group rates, and a dental program which includes no wait on ortho services and major services. It also includes flexible spending accounts, lay worker paid time off or vacation time, paid holidays, called worker professional development, lay worker educational reimbursement assistance, retirement programming, childcare tuition discounts, monetary awards for years of service, plus letter C below.

- MLC regular part-time workers have the ability to purchase health insurance which includes vision coverage, long-term disability at a reasonable rate, corporate life insurance at a reasonable rate with a coverage level at two times the annual salary, voluntary life insurance at reasonable group rates, a dental program which includes no wait on ortho services and major services, flexible spending accounts, lay worker paid time off, paid holidays, lay worker educational reimbursement assistance, retirement programming, childcare tuition discounts, monetary awards for years of service, plus letter C below.

- All workers have the opportunity to attend or stream daily chapel worship during the school year; receive free or reduced admission to athletic events, concerts, and select theater events; free access to the MLC Fitness Center; reduced-price cafeteria meals; campus store discounts; and access to Christ-centered employee and family counseling with the first 10 hours complimentary. In addition, MLC strives to maintain a healthy work-life balance with flexible scheduling and workload management techniques.

- In short, the worker has very few deductions for insurance and benefits, which maximizes their take-home pay.

3 Fiscal year 2024-2025 benefits with employee plus family health insurance

Tenure and Wage Increases

- WELS was founded on December 8, 1849, with DMLC beginning in 1884, and MLC in 1995. With over 175 years “in business,” our earthly mission is longstanding and will continue with the help of God.

- Currently, the average national tenure for an employee to remain with an employer is about 4 years. 4 Our average service record speaks for itself, and 70% of workers give MLC an 8 or higher out of 10 according to our 2022-2023 Satisfaction Survey.

Part-time employees (non-instructors) – the average is 5.50 year

Part-time employees (instructors) – the average is 7 years

Regular part-time employees – the average is 8.75 years

Full-time employees (non-instructors) – the average is 9 years

Full-time employees (instructors) – the average is 10 years to MLC and 22.50 years to WELS

- Currently, the average higher education annual increase percentage is around 3% to 4%. 5 Our annual compensation increases are competitive with the industry, taking into consideration our insurance and benefit offerings, fiscal standing, and religious non-profit status. Compensation increases may occur annually on July 1, at the direction of the WELS president. Annual increases for eligible workers over the last 10 years have ranged from 1.75% to 3.5%, with the average being 2.20%.

- Annual performance evaluations are conducted for employees without sole teaching instruction responsibilities. The college does not adjust wages across the board based on performance ratings, nor does the college operate with a performance-based matrix; rather, it follows the annual increases as stated in number 11. Lay worker merit-based wage adjustments may be provided as part of the annual compensation review referenced in number 4.

4 Bureau of Labor Statistics Employee Tenure in 2024

5 CUPA-HR Higher Education Workforce Survey shows 2017-2024 data.

Compa-Ratio Method

- Using the compa-ratio method means there is a minimum, midpoint, and maximum. Over the last nearly 10 years, MLC has made strategic strides above and beyond the annual increases to adjust the bell curve. Strategies have included correcting green-circled workers (i.e., workers below the minimum of the pay grade), and reminding that when compensation is near the maximum, the worker becomes ineligible for future increases. Once a worker reaches the maximum and is red-circled (i.e., frozen) at that pay rate, they are ineligible for future increases until the pay grade maximum changes, pay grade changes, or job description responsibilities reflect another pay grade.These charts reflect how MLC is continually reviewing compensation for lay workers and sliding the bell curve, intending to shift from lagging the market to meeting the market. These goals take time, as improvements are strategic and involve budgetary planning.

Wage Increases

- MLC continually strives to balance the cost of student tuition with the future earning potential of our graduates as called workers. At a time of declining enrollment in higher education, and with budgets built on student tuition, gifts from donors, and subsidy from WELS, our current deficit financial standing cannot afford increases beyond what is already being done.

Responsibility of Compensation Review

The MLC Administrative Council, together with the HR department, is responsible for implementing, monitoring, and reviewing the compensation philosophy and any legal requirements 6 annually, or more often as the market necessitates, and for helping supervisors understand the role that they play in compensation conversations. Supervisor and employee feedback will be sought regularly to gauge the compensation philosophy’s effectiveness and to identify areas for improvement.

These reviews and requests for feedback are made in an effort to continue to build a strong, cohesive work environment filled with mutual respect and appreciation for the unique talents and gifts that each individual brings to MLC.

6 Minnesota Statute 181.172 gives employees the right to disclose the amount of their own wages to any person as part of the Minnesota Wage Disclosure Protection law. The employer cannot retaliate against the employee for disclosing their own wages. This statute does not permit an employee, without the written consent of the employer, to disclose proprietary information, trade secret information, or information that is otherwise subject to a legal privilege or protected by law.

1 Corinthians 12: 4-6: There are different kinds of gifts, but the same Spirit distributes them.

There are different kinds of service, but the same Lord. There are different kinds of working,

but in all of them and in everyone it is the same God at work.

Updated 01/09/2025

GENERAL BENEFITS AND COMMUNITY BENEFITS

General Benefits

- Chapel Worship – all employees are invited to attend daily chapel services and attendance is not considered “break time.”

- Athletic Events – free admission (employee and family) to MLC athletic events with display of employee badge.

- Drama & Music Productions – reduced admission for select forum drama and musical events with display of employee badge.

Forum box office phone number: 507-233-9114. - MLC Fitness Center – access during hours of operation.

- For days and times, visit https://mlc-wels.edu/fitness-center/.

- MLC employees – gain access using your employee badge.

- WELS members – gain access by purchasing a $5.00 Fitness Center access card (one-time purchase).

- Employee Assistance Program – Christian Family Solutions (CFS) provides Christ-centered, Bible-based counseling and education

for the employee, their spouse, and their dependent children, with the first 10 hours per year complimentary. - Cafeteria – reduced meal prices with display of employee badge or nametag.

Includes employee, spouse, and children. Employee must be present. Child price is for ages 4-6. Under 4 eat free.

-

- Breakfast: Monday through Friday – $3.25 per person, $1.65 per child

- Lunch: Monday, Wednesday, and Friday – $3.75 per person, $1.90 per child; and

Tuesday and Thursday “Feeding Frenzy” – $3.00 per adult, $1.50 per child (11:00 a.m. – 2:00 p.m.) - 10-Meal Lunch Card: $34.25

- Dinner: $4.25 per person, $2.15 per child

- 10-Meal Dinner Card: $38.75

- Steak & Special Meals: $4.75 per person, $2.40 per child

- Discounted Flex Dollars – MLC employee badge

- This feature offers you a quick and easy way to pay for your meals. You can add flex dollars directly in the cafeteria or by visiting https://oncampusdining.com/mlc-wels/product/flex-dollars/ and adding your preferred dollar amount. For example, per the bonus details below, if you add $100, your account will be credited with $120 flex dollars! Please note that flex dollars purchased in the cafeteria may be used immediately, while flex dollars purchased online take some time to show up in the account, due to back-end processing.

- Flex dollar purchases up to $99.00 receive a 10% bonus in purchasing power.

- Flex dollar purchases greater than $99.00 receive a 20% bonus in purchasing power.

- A refund may be requested upon end of employment if dollars remain.

- Reusable To-Go Containers – take a single meal to go by requesting a reusable to-go container at the front counter. Exchange it (clean) for a fresh one at your next visit.

- “Donut Wednesday” – includes bakery goods and fresh fruit, when school is in session.

- Library – use your employee badge at any Traverse des Sioux library (New Ulm, Mankato, St. Peter, etc.). No overdue fines for items checked out at the MLC Library. Items checked out at other TdS libraries follow local policies. Employees will be billed for lost or damaged items.

- Bookstore – MLC Fridays: 10% off regularly priced MLC clothing for all employees, students & alumni, PLUS an additional 10% off regularly priced MLC clothing for anyone wearing MLC apparel at the time of purchase.

- Workers’ Compensation – employees are provided a comprehensive workers’ compensation insurance program at no cost.

- Unemployment Compensation – WELS and MLC are exempt from paying unemployment compensation taxes; therefore, employees are not eligible for unemployment compensation benefits.

- Scheduling – flexible scheduling and workload management techniques to foster a healthy work-life balance.

- Employee Sick and Safe Time – exempt employees and non-exempt employees who are not already covered by the PTO Policy accrue one hour of paid sick and safe time for every 30 hours worked.

- Uniforms – provided by MLC initially and every two years thereafter, consisting of shirts, pants, shoe allowance, and outerwear (applicable to Environmental Services positions only).

- Licenses or Certificates – MLC will ensure that fees are paid and training requirements are met to keep current or valid any certificates or professional licenses of importance to an employee’s position and the success of the college.

Schedule of Benefits by Employee Type - Regular Full-time

Regular full-time employee:

Regular schedule of at least 40 hours per week.

- WELS VEBA Group Health Care – coverage is available at no charge for any tiered coverage, including family coverage, if selecting the high-deductible Plan 4 with health reimbursement account (HRA). This plan has a $3,500 individual/$7,000 family deductible, effective on the latest of the following dates: 1) employment effective date; 2) date enrollment form is completed; or 3) date of requested coverage, but not more than 60 days after employment start date or a “qualifying event.”

- Plan 4 with HRA is synod sponsored. When using the HRA, it is designed to match the Plan 2 deductible and out-of-pocket expense.

- May elect Plan 1, which has a $500 individual/$1,000 family deductible. Employee would pay the difference between Plan 1 and Plan 2. Billed to college for payroll deduction.

- May elect Plan 2, which has a $1,000 individual/$2,000 family deducible. Employee would pay entire premium. Billed to college for payroll deduction.

- Vision Coverage – included as part of WELS VEBA Group Health Care enrollment, at no charge. Vision coverage without health care coverage is not available.

- Corporate Life Insurance – required coverage at two times the annual salary with a maximum of $300,000 at no expense to the employee. IRS regulations require the amount of coverage over $50,000 to be reported as a “taxable fringe benefit.” The amount of “imputed income” will appear on your pay statement.

- Supplemental Voluntary Life Insurance – 60-day enrollment window for new hires with no evidence of insurability (EOI) of coverage levels for specific amounts for employee and spouse. If electing outside of the new-hire window, an EOI may be required prior to beginning coverage or adding coverage. Billed directly to employee.

- Short-Term Disability – automatic compensation coverage at no charge, to help an employee cope with an injury or illness that results in the employee being absent from work for more than five (5) consecutive work days.

- Non-exempt employee: the first 10 days you may use PTO to supplement; the second 10 days, PTO is required. If the employee’s PTO balance is exhausted before 20 days, those days will be unpaid.

- Exempt employee: the first 20 days are paid at the regularly scheduled level of compensation.

- On the 21st day the monthly amount would be equal to two-thirds your monthly salary. The 21st day through the 90th day will be paid at two-thirds of the employee’s pre-disability rate.

- Lay worker: may use PTO/vacation time to compensate for the one-third of unpaid monthly salary.

- Long-Term Disability – optional coverage at the employee’s expense; automatic enrollment if enrolled in WELS VEBA Group Health Care; 60-day new-hire enrollment window with no evidence of insurability (EOI). If electing coverage outside of the new-hire window, an EOI may be required prior to beginning coverage. Coverage generally starts on the 91st day of a documented disability, providing

two-thirds partial salary continuation in the event of a non-work-related injury or illness. Premium is based on annual earnings. Billed to college for payroll deduction. Annual earnings for called workers includes base salary, housing allowance, utilities allowance, and SECA.- Employee with annual earnings of less than $50,000: premium is $15.00/month.

- Employee with annual earnings of more than $50,000: premium is $16.50/month.

- Delta Dental of WI – eligible to secure at the employee’s expense (60-day new-hire enrollment and qualifying event window). Coverage includes cleanings, exams, x-rays, major services, and no-wait orthodontia for those under age 19. Billed to college for payroll deduction.

- Flexible Spending Account – eligible to designate deductions from compensation on a pre-tax basis to pay for medical and/or dependent care expenses; must maintain the designated deduction amount for the entire year unless a “qualifying event” occurs (30-day new-hire enrollment and qualifying event window). Billed to college for payroll deduction.

- Defined Contribution Plan – (was WELS Pension Plan) for all called workers regardless of hire date, and for lay workers hired prior to 01/01/2015, automatic participation at college’s expense at the respective full-time rate. In addition to the base contribution, workers who have attained age 44 on January 1, 2022, will receive an “additional” contribution per quarter of eligible full-time service, or Shepherd Match Plan if hired after 01/01/2015.

- Shepherd Match Plan – for a lay worker hired after 01/01/2015, participation in the Shepherd Contribution Plan with an automatic non-elective contribution of $1,000 per year, plus 100% match on the first 3% of voluntary contributions, and 50% match on the next 3% of voluntary contributions. In total, if the employee elects to contribute 6% of earnings, MLC will match the contribution 75%.

- WELS Shepherd Plan – eligible to voluntarily contribute to the 403(b) plan beyond the Defined Plan or Match Plan to save on a pre-tax basis or under the Roth provision for supplemental retirement; may enroll at any time and change contribution levels at any time. Billed to college for payroll deduction.

- Paid Time Off or Vacation – non-exempt employees will accrue paid time off (PTO) and exempt employees will accrue vacation time; both accruals are based on years of eligible service. PTO is used for rest, relaxation, personal pursuits, appointments, illness, and any other ESST-related reason. Vacation is used for rest, relaxation, and personal pursuits.

- Holidays – employees receive 11 paid holidays, in accordance with the WELS holiday schedule.

- Jury Duty – employees summoned for jury duty will be granted leave with pay to serve on jury duty.

- Bereavement – employees who experience a death of an immediate family member will receive bereavement leave pay based on the relationship (i.e., spouse, child, mother, father, etc.)

- Educational Reimbursement Assistance – through an application process, MLC will pay 100% of educational expenses up to a maximum of $3,000 per calendar year.

- ECLC tuition – reduced tuition (20% discount on youngest child and 10% discount on older children, if applicable) at the Early Childhood Learning Center (ECLC) for infants, toddlers, and pre-primary aged children based on availability. Call ECLC for details: 507-233-9105.

- Service Awards – employees are honored with a monetary gift at 10 years of service, and every 5 years thereafter.

- Vogel Recreation Center – access Vogel Recreation Center by scanning your MLC Employee ID at Vogel’s MLC

check-in scanner (some exclusions/fees may apply).- If you use the Rec Center consistently more than 6 times each month, you should purchase an individual membership and turn in the receipt to the Executive Assistant of Student Life for reimbursement.

- If both you and your spouse are benefit-eligible and are consistently using the Rec Center more than 6 times each month, you should consider the savings offered by the Rec Center for those wishing to add an additional member to their membership.

- If you use the Rec Center consistently more than 6 times each month, you should purchase an individual membership and turn in the receipt to the Executive Assistant of Student Life for reimbursement.

- General Benefits and Community Benefits.

Schedule of Benefits by Employee Type - Regular Part-time

Regular schedule of 20 hours or more per week, but less than 40 hours per week.

- WELS VEBA Group Health Care – coverage at the employee’s expense. Coverage is effective on the latest of the following dates: 1) employment effective date; 2) date enrollment form is completed; or 3) date of requested coverage, but not more than 60 days after employment start date or a “qualifying event.”

- May elect Plan 4, which is a high-deductible plan with a $3,500 individual/$7,000 family deductible. Health reimbursement account (HRA) is not included. Billed to college for payroll deduction.

- May elect Plan 1, which has a $500 individual/$1,000 family deductible. Billed to college for payroll deduction.

- May elect Plan 2, which has a $1,000 individual/$2,000 family deductible. Billed to college for payroll deduction.

- Vision Coverage – included as part of WELS VEBA Group Health Care enrollment, at no charge. Vision coverage without health care coverage is not available.

- Corporate Life Insurance – required coverage at two times the annual salary with a maximum of $300,000. Premium is at the employee’s expense based on annual salary. IRS regulations require the amount of coverage over $50,000 to be reported as a “taxable fringe benefit.” The amount of “imputed income” will appear on your pay statement.

- Supplemental Voluntary Life Insurance – 60-day enrollment window for new hires with no evidence of insurability (EOI) of coverage levels for specific amounts for employee and spouse. If electing outside of the new-hire window, an EOI may be required prior to beginning coverage or adding coverage. Billed directly to employee.

- Long-Term Disability – automatic enrollment and no premium if enrolled in WELS VEBA Group Health Care due to paid health premiums; optional coverage for employees who are not enrolled in the WELS VEBA Group Health Care Plan is available at the employee’s expense. 60-day new-hire enrollment window with no evidence of insurability (EOI). If electing coverage outside of the new-hire window, an EOI may be required prior to beginning coverage. Coverage generally starts on the 91st day of a documented disability, providing two-thirds partial salary continuation in the event of a non-work-related injury or illness. Premium is based on annual earnings. Billed to college for payroll deduction.

- Delta Dental of WI – eligible to secure at the employee’s expense (60-day new-hire enrollment and qualifying event window). Coverage includes cleanings, exams, x-rays, major services, and no-wait orthodontia for those under age 19. Billed to college for payroll deduction.

- Flexible Spending Account – eligible to designate deductions from compensation on a pre-tax basis to pay for medical and/or dependent care expenses; must maintain the designated deduction amount for the entire year unless a “qualifying event” occurs (30-day new-hire enrollment and qualifying event window). Billed to college for payroll deduction.

- Defined Contribution Plan (was WELS Pension Plan) – For all called workers regardless of hire date, and for lay workers hired prior to 01/01/2015, automatic participation at college’s expense at the respective rate, either half-time or three-quarter time. In addition to the base contribution, workers who have attained age 44 on January 1, 2022, will receive an “additional” contribution pro-rated per quarter, or Shepherd Match Plan if hired after 01/01/2015.

- Shepherd Match Plan – for a lay worker hired after 01/01/2015, participation in the Shepherd Contribution Plan with an automatic non-elective contribution of $500 per year, plus 100% match on the first 3% of voluntary contributions, and 50% match on the next 3% of voluntary contributions. In total, if the employee elects to contribute 6% of earnings, MLC will match the contribution 75%.

- WELS Shepherd Plan – eligible to voluntarily contribute to the 403(b) plan beyond the Defined Plan or Match Plan to save on a pre-tax basis or under the Roth provision for supplemental retirement; may enroll at any time and change contribution levels at any time. Billed to college for payroll deduction.

- Paid Time Off or Vacation – non-exempt employees will accrue paid time off (PTO) and exempt employees will accrue vacation time; both accruals are based on years of eligible service. PTO is used for rest, relaxation, personal pursuits, appointments, illness, and any other ESST-related reason. Vacation is used for rest, relaxation, and personal pursuits.

- Holidays – employees receive 11 paid holidays, in accordance with the WELS holiday schedule.

- Jury Duty – employees summoned for jury duty will be granted leave with pay to serve on jury duty.

- Bereavement – employees who experience a death of an immediate family member will receive bereavement leave pay based on the relationship (i.e., spouse, child, mother, father, etc.)

- Educational Reimbursement Assistance – through an application process, MLC will pay 100% of educational expenses up to a maximum of $1,500 per calendar year.

- ECLC tuition – reduced tuition (20% discount on youngest child and 10% discount on older children, if applicable) at the Early Childhood Learning Center (ECLC) for infants, toddlers, and pre-primary aged children based on availability. Call ECLC for details: 507-233-9105.

- Service Awards – employees are honored with a monetary gift at 10 years of service, and every 5 years thereafter.

- Vogel Recreation Center – access Vogel Recreation Center by scanning your MLC Employee ID at Vogel’s MLC

check-in scanner (some exclusions/fees may apply).- If you use the Rec Center consistently more than 6 times each month, you should purchase an individual membership and turn in the receipt to the Executive Assistant of Student Life for reimbursement.

- If both you and your spouse are benefit-eligible and are consistently using the Rec Center more than 6 times each month, you should consider the savings offered by the Rec Center for those wishing to add an additional member to their membership.

- If you use the Rec Center consistently more than 6 times each month, you should purchase an individual membership and turn in the receipt to the Executive Assistant of Student Life for reimbursement.

- General Benefits and Community Benefits.

Schedule of Benefits by Employee Type - Part-time

Scheduled to work less than 20 hours per week.

Updated 01/27/2025

Important Applicant Notices

- Martin Luther College’s Annual Security Report is public safety information about our campus and can be accessed by clicking here or by visiting https://mlc-wels.edu/student-life/annual-security-and-fire-report/

- Martin Luther College’s Title IX Policy can be accessed by clicking here or by visiting https://mlc-wels.edu/student-life/title-ix-policy/

- Small Business Administration notice regarding Equal Employment Opportunity can be viewed here or by visiting https://www.sba.gov/sites/default/files/files/forms_mis772_3.pdf