By JoElyn Krohn, MLC financial wellness coordinator

“What can we do to help our student cover the cost of college and avoid loan debt?”

Maybe this is a question you’ve been thinking about. We think about it a lot too.

Educational expenses for 2025-2026 at MLC have been set. There was a slight increase to tuition, room and board costs, but the funding allocated to financial aid was also increased to compensate for this change.

| Tuition | Food & Housing | TOTAL | |

| 2024-2025 | $18,120 | $7,900 | $26,020 |

| 2025-2026 | $18,660 | $8,720 | $27,380 |

What Are Some Strategies for Paying for Educational Costs?

Review the four main components below and visit our website for more detailed information: mlc-wels.edu/financial-aid/paying-for-college/

1. APPLY FOR FINANCIAL AID

Students and families are primarily responsible for covering the cost of attending college, but financial aid can assist them. Students applying for aid must complete the FAFSA (Free Application for Federal Student Aid) and the MLC Financial Aid Application by April 15.

The information from the FAFSA determines each student’s eligibility for financial aid. (Over 95% of families received some form of financial aid from MLC this year!) NOTE: Families will need to report 2023 income for their 2025-2026 FAFSA. The new FAFSA is available now!

Since not all circumstances can be explained on the FAFSA, we encourage you to communicate special circumstances impacting your family’s financial situation to the Financial Aid Office so we can offer special consideration. Forms explaining your special circumstances can be found on our website: mlc-wels.edu/financial-aid/special-circumstances.

2. SEARCH FOR SCHOLARSHIPS & GRANTS

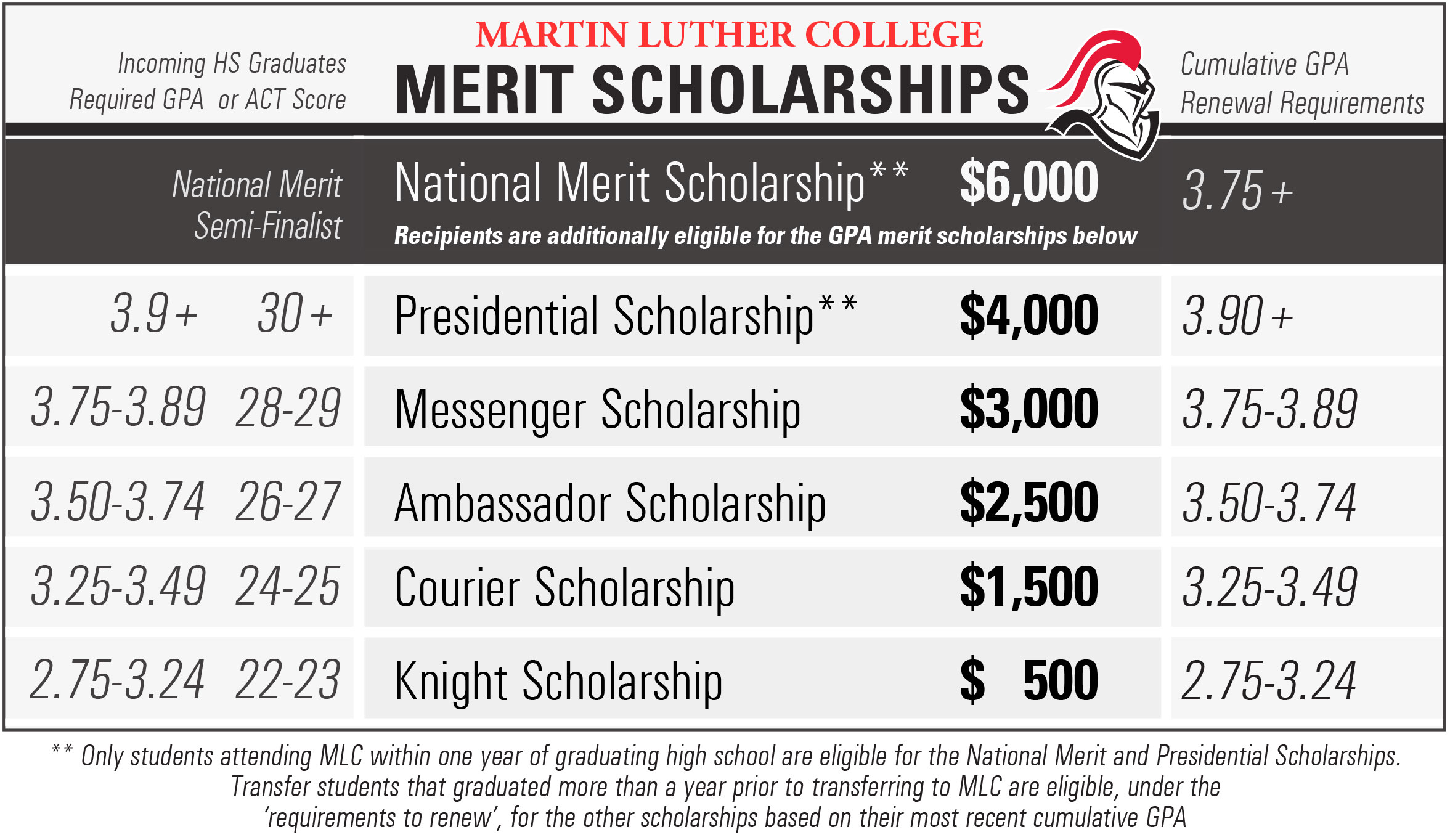

Scholarships and grants are a great way for students to reduce the cost of education. MLC has several merit-based renewable scholarships.

..

In addition to merit-based scholarships, we also offer donor-funded scholarships and grants. Donor-sponsored scholarships (based on merit) might require a certain GPA, a project, or a paper. Donor-sponsored grants (based on financial need) might require students to write an essay expressing their financial need and their desire to serve in the ministry.

Students should also pursue scholarships in their communities, through their employers, through their parents’ employers, and by using one of the many scholarship searches.

Millions of dollars are given in scholarships each year. The process of searching for and applying to the many scholarships is time-consuming, but it can pay off big time! For more scholarship information, please review the information on our scholarship page: mlc-wels.edu/financial-aid/scholarships/.

3. SEEK EMPLOYMENT

Not every student can handle a job in addition to completing school work and acclimating to a new college campus, but sometimes it’s essential for covering out-of-pocket costs.

Many on-campus jobs are available in the cafeteria, library, music department, athletic department, and various offices. Students also work as tutors, teaching assistants, and resident assistants. We make a concerted effort to expand student jobs whenever possible.

Many off-campus jobs are available as well. New Ulm area residents often contact MLC requesting student help. Some jobs are flexible, like tutoring a grade school student, and some are more structured, like working a shift at a company in town. Both on- and off-campus job opportunities can be reviewed on the Student Employment website: mlc-wels.edu/student-employment/.

Even if students are not working during the academic year, the summer is an excellent time to save up money for school. It’s very possible for students to earn around $3,500 to help cover about half of the food and housing charges. Students who contribute to their college education often take greater pride in their accomplishment. It also helps prepare them for the reality of balancing all the bills and responsibilities after college.

4. TAKE OUT LOANS

Taking on debt is a responsibility that should not be taken lightly. Unfortunately, student loans are a necessity for many families in order to help shoulder the increasing costs of higher education.

If a family must take out loans for college, we advise you to start with the federal loan eligibility. Federal Direct loans typically have a lower interest rate and flexible repayment options. Subsidized loans are a great option, since the government covers the interest that accrues while the student is enrolled at least half-time.

The general rule is this: Do not borrow more for your education than you will make your first year after college. The base salary for first-year teachers at synod code is currently $31,365. Our graduates continue to stay under this total. Of the 2024 graduates who took out loans, the average loan debt was $21,676 (with an estimated repayment of $235/month based on a 5% interest rate).

What Is MLC Doing to Help?

MLC is finding various ways to keep costs low while still offering substantial financial assistance. A ten percent boost every year in our financial aid and our Congregational Partner Grant Program will help get us there!

How does the Congregational Partner Grant Program work? The home congregation of each student can support the ministry of that student by providing a grant to help reduce the cost of tuition. MLC will then match these contributions dollar for dollar up to a maximum amount of $1,450 per student (up to $1,600 per student in 2025-2026). More information about this program can be found on our website: mlc-wels.edu/cpgp.

We also offer financial guidance through MLC Direction, a program we initiated in August 2015. As the full-time financial wellness coordinator, I help students better understand financial topics and make wiser financial decisions now, alleviating financial pressure in the future. Students have various opportunities to improve their financial education:

- CashCourse Topics: All students are required to complete specific financial topics electronically each year through CashCourse.

- Group Presentations: Certain groups of students are scheduled to learn various topics in peer groups.

- Individual Meetings: Graduating students have the opportunity to review their total loan debt, estimate their future payments, and create a personalized budget based on projected income and expenses. All students are invited to make individual meetings to review personal financial situations.

Many excellent resources are available to students and families on our website: mlc-wels.edu/financial-aid/mlcdirection. You can also stay informed through our Facebook page: facebook.com/mlcdirection.

We hope that the MLC Direction resources, meetings, online topics, and group presentations will help students develop better financial understanding and habits. Through hard work and support from family and the college, students can minimize their debt and maximize their income. After all, if they live like a college student now—scrimping and saving—they won’t have to in the future!